Every small business wants to have its invoices paid faster. Especially to have enough funds to cover expenses and have a safety net. But unfortunately, they do not usually have enough safety net to cover them otherwise. Therefore, regardless of the size of our businesses, we can often experience struggles with on-time or early payments.

While large companies can survive a few late payments, that’s not always the case for a small business. Below, you’ll discover some excellent tips on how your clients can pay you faster.

Can Your Small Business Survive Late Or Missed Payments?

Starting your small business comes with a list of concerns and often headaches. But that doesn’t mean you should avoid the excitement and opportunity starting a new business can bring. It’s always good to know what struggles your small business can face and prepare beforehand.

The U.S Small Business Administration states that the U.S. has 31.7 million small businesses growing. Moreover, they state, from 2000 to 2019, small businesses created 10.5 million net new jobs. And large businesses created 5.6 million. Small businesses have accounted for 65.1% of net new job creation since 2000. And quarterly small business job gains, losses, and net new jobs since 2000.

With that said, receiving on time or early payments can present issues for small business owners. In 2021 overdue invoices counted for approximately 22% of digital invoices. Above all, it’s essential to know how to avoid overdue invoices and keep your business running smoothly.

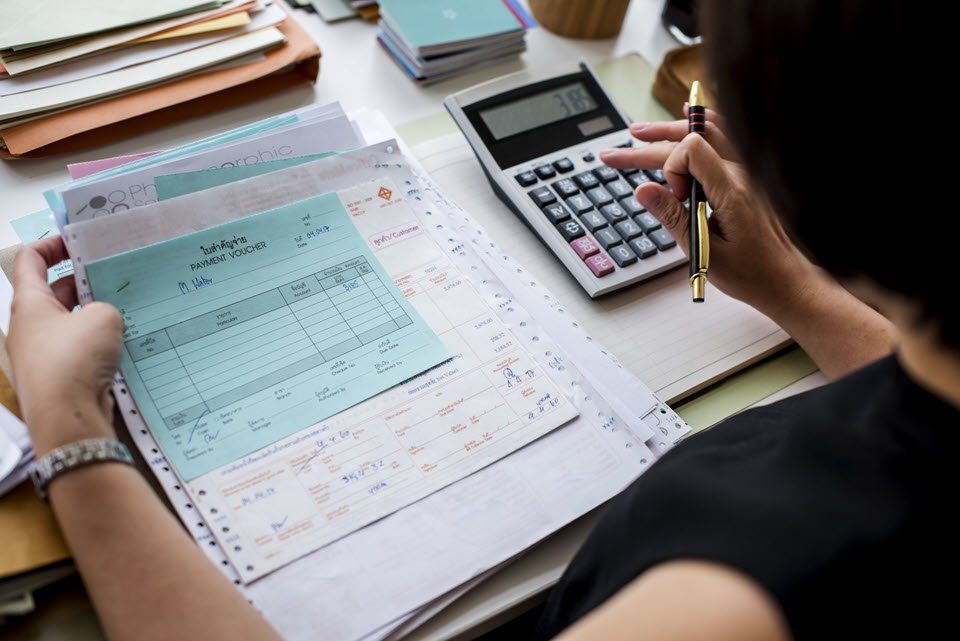

Use Clear And Straightforward Invoices

One of the most critical factors to help you receive payment on time is having clear and straightforward invoices. For example, suppose clients are struggling to understand their invoices. In that case, this will cause a significant delay in them making payment. Typically, they have to spend time figuring it out or possibly because they have to get in touch with you for clarification.

Furthermore, you can use an invoice template to streamline your payment process. Creating accurate and professional-looking invoices within seconds will ensure you have more time to spend on running your business and encourage your clients to not only pay you on time but potentially earlier!

Do Not Delay Invoicing

Sometimes payment delays may not be down to your clients but down to you. Your customers can only pay you as quickly as you invoice them. You might forget if you have an overload of work. That’s why it’s a good idea to issue your invoices as soon as you complete the job. Make it part of your routine when carrying out the work for your clients. By doing so, you will create a habit of ensuring your invoices go out early.

Make Your Payment Terms Clear

Set clear payment terms upfront and outline these terms on your invoices. Explain to your client when the payment is due. And any late fees they may incur if they fail to meet this deadline. Above all, you should make these things clear from the outset while reducing the chance of any confusion further down the line. You should also include your contact details on your invoices should the client have any additional questions regarding the charges.

Accept More Payment Methods As A Small Business

One reason for a payment delay is that your client’s preferred payment method is not one you support. And this means they will have to make other plans on how to pay the invoice. As a small business, you should make it easy for customers to pay you. Mainly because you will receive your money quickly and because it is just good customer service.

Additionally, consider accepting online or mobile payments as these are becoming increasingly popular ways to conduct business. It would be best to allow automatic payments should your client prefer this. This way, they do not have to make the payment actively. And you will know precisely you’ll receive compensation.

Enforce Penalties For Late Payments

Late fees are an excellent way to motivate your customers to pay you on time. More so, it’s a good idea to let your clients know about the consequences of late payment. In addition, this can also prevent any clients from making a habit of missing payment deadlines. Outline these fees on your invoices and discuss them with the client before beginning the project. This way, you won’t experience any surprises or unpleasantness born from a lack of communication.

The Benefits Of Blogging For Your Business And Marketing Needs

The benefits of blogging are far-reaching and crucial for your business and marketing needs, especially in today’s competitive climate. As you know, it’s always a challenge to make your business stand out from the rest.

Learn MoreOriginal Article